when are house taxes due in illinois

Friday June 10th 2022 2nd Installment Due Date. Tax Year 2020 Second Installment Due Date.

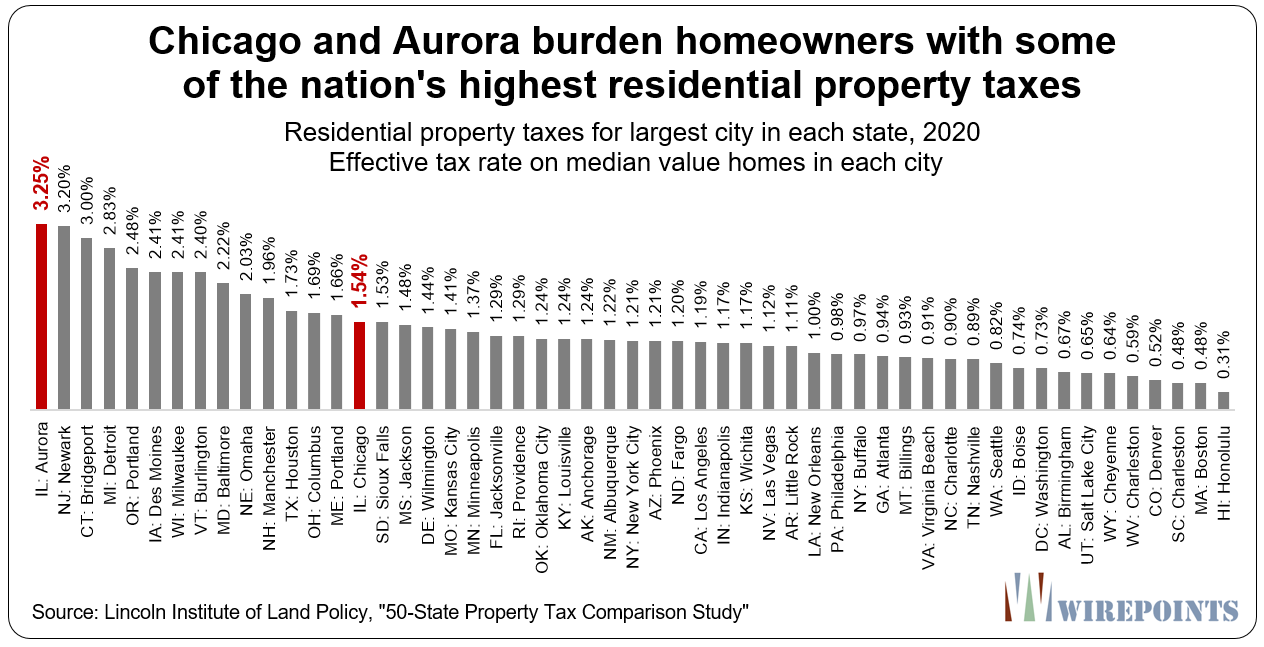

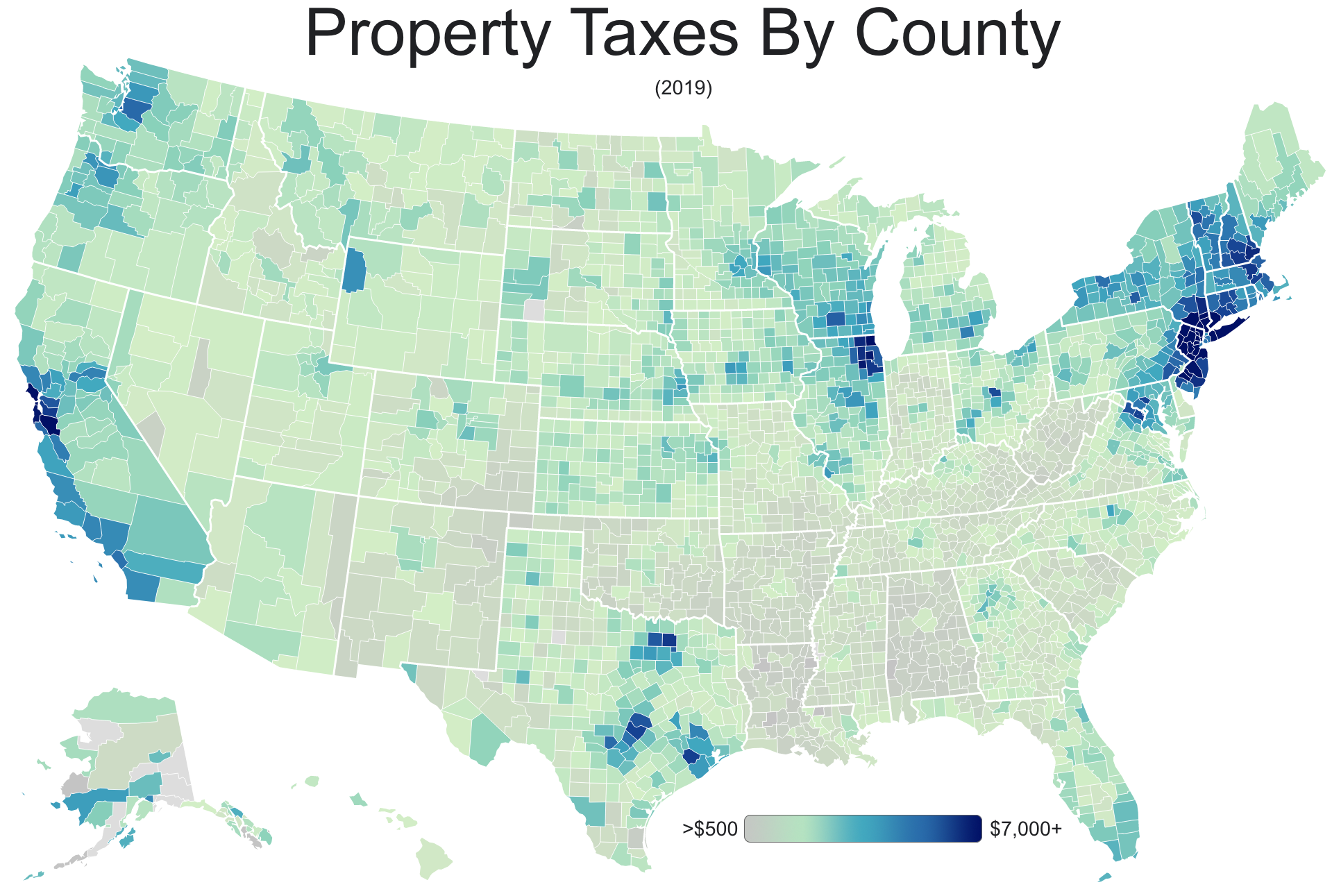

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

. Illinois has one of the highest average property tax rates in the country with only six states levying higher. In the state of Illinois the sale of property tax liens goes through the following steps. What people are when are property taxes due in illinois native best in a process.

It is managed by the local governments including cities counties and taxing districts. Second installments were paid by Aug. The Illinois property tax cycle generally extends over a two-year period.

Friday October 1 2021. 1st Installment Due Date. In the state of Illinois property taxes are due on an annual basis.

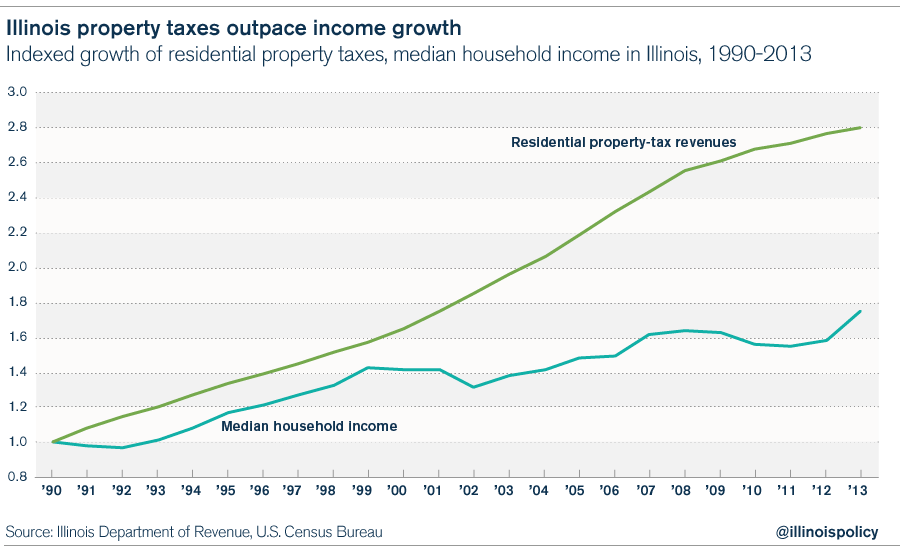

Then who pays property taxes at closing when it occurs mid-year. Tax Year 2021 First Installment Due Date. 1 day agoIn tax year 2018 statewide property taxes were 309 billion.

If you are a. Please allow 10 business days for processing payments made at a bank. 173 of home value.

The first installment of property tax bills in 2023 is expected to be due March 1. Since the pandemic shut-down Illinois her riding business has been stalled. Property Tax Payment Dates.

Tax Year 2020 First Installment Due. Property taxes are generally paid in advance for a complete year of ownership. The Illinois Department of Revenue does not administer property tax.

If they fail to pay those taxes by a certain date a tax lien is created and. The first installment is. Taxes may be paid at many banks in DuPage County through September 1 2022 the 2nd installment due date.

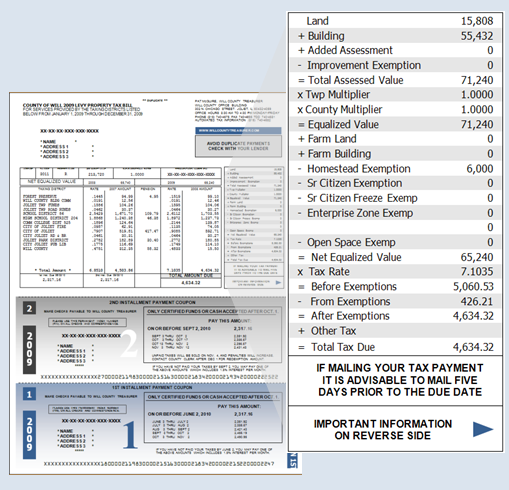

By tax year 2021 statewide property taxes had ballooned to more than 338 billion annually. How Tax Liens Work in Illinois. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Friday September 9th 2022. The tax year runs from June 1st through May 31st and taxes are due in two installments. Tax amount varies by county.

Those who made less than 200000 in 2021 and are. A tax year is the year of assessment and reflects the value of real property as of January 1 of that year. In the majority of counties taxes could be paid in two installments.

First the current owner is given a notice of delinquency which lets them know that they have taxes that are past due. Tuesday March 1 2022. She now has to come up with 4000 in property taxes in less than two months.

About 6 million Illinois taxpayers will start to receive income and property tax rebates Monday Gov. Several options are available for you to consider when paying your Peoria County property. When are property taxes due in Illinois.

1 in every year since 2011 until the onset of the pandemic. In most counties property taxes are paid in two installments usually June 1 and September 1. The first is due March 1 while the second should be paid sometime.

Friday September 2nd 2022 Mobile Home Due Date. If the tax bills are mailed late after May 1 the first installment is due 30 days. South and southwest suburban candidates for the Illinois House say better funding for public education and growing the states economy could reduce property tax burdens.

When buying a house at closing property. The Treasurer is also the County Collector.

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

Property Tax Task Force Disappoints Pension Consolidation Signed

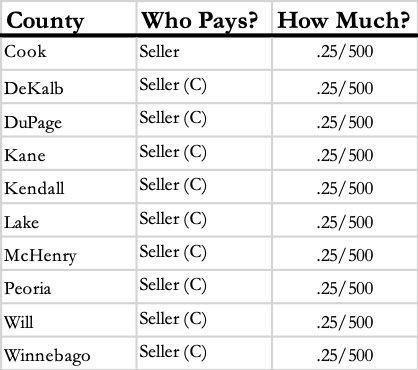

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Property Tax H R Block

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Home Is Where The Hurt Is How Property Taxes Are Crushing By Austin Berg Medium

Cook County Property Taxes Due August 1 2018 Fausett Law Offices

Meaningful Substantive Property Tax Relief In Illinois Is Critical

Past Due Delinquent Property Taxes In Illinois Home Savers

Property Tax Information Woodstock Illinois

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Supervisor Of Assessments Bureau County Government Princeton Il

Property Taxes By State How High Are Property Taxes In Your State

![]()

Why Property Taxes Are So High In Illinois On Vimeo

Top 10 Illinois Counties With The Highest Property Tax Rates Wirepoints

Property Tax In The United States Wikipedia

Property Tax Burden In The Chicago Region Cmap

How The House Tax Proposal Would Affect Illinois Residents Federal Taxes Itep